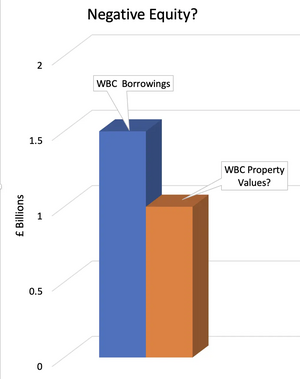

How large is Woking Borough Council's Negative Equity?

We all know that when times are tough there is a risk that the mortgage on our home may exceed the price we can sell it for. WBC has borrowed at least £1.5 Billion to plough into property development in the last few years. Many of these properties are being developed by companies owned in whole or in part by WBC.

The last published accounts for these companies were for the year ended 31 December 2018. As we all know a lot has happened since then. In those accounts the Directors made a formal statement to the auditors that the assets of the company were valued at the lower of cost and net realisable value. That is to say, in their opinion, there is in effect no negative equity.

That was over 2 years ago! Is that still the case today? We need to know and to know now.

A Lib Dem controlled council will obtain a full financial audit and Statement of Affairs of all WBC's assets and liabilities including those of its many property development companies. Once we have this information we can at least begin to assess the options available and recommend a way forward.

Residents might sleep better if they knew the finances have been fully assessed by independent professionals.

Cllr Graham Chrystie

Email: Graham.Chrystie@wokinglibdems.org.uk

Facebook: Facebook.com/PyrfordLibDems